5 Simple Techniques For Accountant Meaning

Wiki Article

A Biased View of Accountant Salary

Table of ContentsAll About Accountant UniformThe Only Guide to Accountant Application LetterMore About Accountant AttireThe 8-Minute Rule for AccountantWhat Does Accountant Application Letter Do?Accountant Salary for Beginners

If you're not considering the recordkeeping and also bookkeeping, the probabilities are that your documents are a mess, as well as you're hardly scuffing by. Accountants do so much, as well as they do it with proficiency as well as effectiveness. That makes a substantial distinction for a company - accountant application letter. Certainly, audit is a large area, and also accountancy solutions can consist of several points.Solutions can consist of speaking with on computer system systems, company valuations, and also retirement choices. Audit While every one of these solutions drop under the umbrella of bookkeeping, accounting normally refers less to recordkeeping and also even more to analysis and analysis. While recordkeeping has to do with gathering and also maintaining data, a lot of audit is functioning with that information as well as creating concrete choices or recommendations based on that data.

That's where these accounting professionals come in. Inner auditing provides administration and the board of directors with a value-added service where problems in a procedure might be captured as well as remedied. This is vital for protecting firms from responsibility for fraud too. The Sarbanes-Oxley Act of 2002 set new business accounting criteria as well as enforced severe criminal charges for monetary fraud.

Getting My Accountant Attire To Work

Tax Accounting Tax obligation bookkeeping is likely one of the most usual bookkeeping solution used by exclusive people. Tax accountants concentrate on preparing tax obligation returns and assisting people and also business to load you their kinds and pay their taxes. Tax legislation is constantly made complex and also constantly altering, so these accountants have to remain current on every one of the regulations and also regulations.Forensic Audit Forensic bookkeeping is regarding examination and litigation assistance. This solution is generally included with legal actions as well as accusations of fraudulence, embezzlement, or cash laundering.

Accounting Bookkeeping is regarding keeping accurate and also detailed documents. This is the support of bookkeeping. Without information gathered by bookkeeping, accounting professionals have nothing to collaborate with. Tape keeping for little services can provide a red-hot snapshot of a firm's monetary situation and wellness. It involves keeping an eye on all inputs as well as results as well as double-checking whatever to see to it it's been properly videotaped.

What Does Accountant Salary Mean?

That's unavoidable, and also a good bookkeeping system will certainly catch those mistakes. That's where financial institution reconciliation can be found in. Financial institution settlement is a procedure of examining and also contrasting your financial documents to those of your bank and also repairing errors if the documents don't match the means they're intended to. You process payments and afterwards deposit those payments in the bank.Accounts Payable Accounts payable are a crucial part of your basic journal and also a crucial indicator for analyzing your business's economic circumstance at any provided moment. You need to keep an eye on every one of your settlements and expenditures under accounts payable. As quickly as you intend or arrange a cost, it should be tape-recorded in this account.

Keeping track of cash money settlements you make will certainly provide you a feeling of just how much money you have on hand. Accounts payable is a category that consists of future expenditures as well, which helps you prepare. If you have a rate of interest payment on an organization financing due in the next month, you can prepare suitably to have the money when you need it.

Some Known Details About Accountant Uniform

If a customer gets an item on credit report or with an extensive repayment strategy, you need to understand when you expect to get that income. You could not have the ability to obtain that money as soon as possible, but you can prepare future costs based upon the expected in-flows from those receivables.

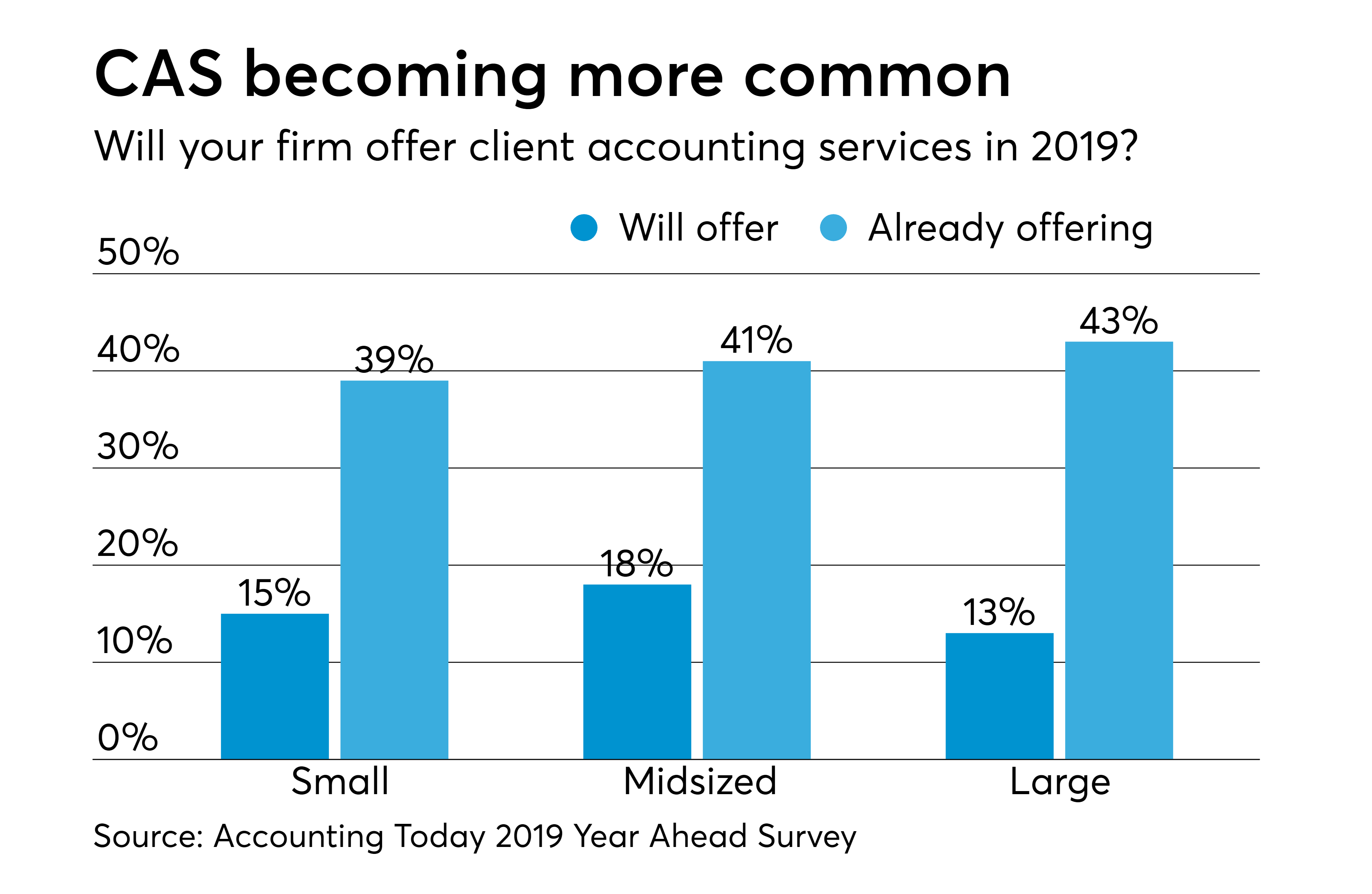

Audit firms can come in numerous selections. For years, standard accountancy firms given services in 2 major classifications: audit & attestation solutions, and also tax obligation services.

Accounting Assistant Job Description - Questions

Among the her explanation primary functions of a conventional audit company is the efficiency of audit and also various other attestation solutions. While audits serve a vital feature, they are not needed for most little and mid-sized companies and also are as a result not top of mind for the majority of entrepreneurs. Tax obligation Services When you mention audit, people commonly consider tax services.Tax obligation is a highly specialized location that needs an one-of-a-kind ability. Companies that give tax solutions utilize a group of very trained specialists that remain up to date on the current tax code in order to prepare service as well as personal tax returns and give tax obligation recommendations. While an excellent tax accounting professional is very useful, you must take care not to presume they are specialists in all areas of audit.

Frequently they would finish up aggravated with the outcomes. Tax obligation accountants learn this here now are wonderful at what they do, yet they are usually not professionals on operational accounting as well as unqualified speed on the most up to date technology applications that drive performances. With the emergence of outsourced accounting services, this has actually all changed.

Accountant for Dummies

The Outsourced Services category is without a doubt the fastest expanding area of expertise for accounting firms. Outsourcing as a whole is popular because it provides little and also mid-sized services a wonderful way to get the expertise they need in a fractional, cost-effective model. Some companies, specifically bigger a lot more recognized companies, have their own inner accounting division as well as hire their own team to do their bookkeeping and also bookkeeping.Report this wiki page